A) About Data Science

Data is something that can either bring a business too down or be highly earned. So, I believe that data is the backbone of every industry and is never-ending because only data can make companies grow in the future. So, I also concluded that data science is going to provide numerous jobs in the future and with this vision, I started learning data science. I start my journey of data science from python and going on up to machine learning & neural networks.

After getting an experience of 1 year working in ml and python I prepared a NILM (Non-Intrusive Load Monitoring ) dashboard in DASH (a data science framework for python).

B) Problem Statement

It is a very difficult job for a human to measure the 'load of an electronic device' every minute/second and find out which device is exceeding its limit

But, yes this task is possible for a machine so I need to prepare an algorithm that continuously monitors the load of an electronic device.

C) Solution

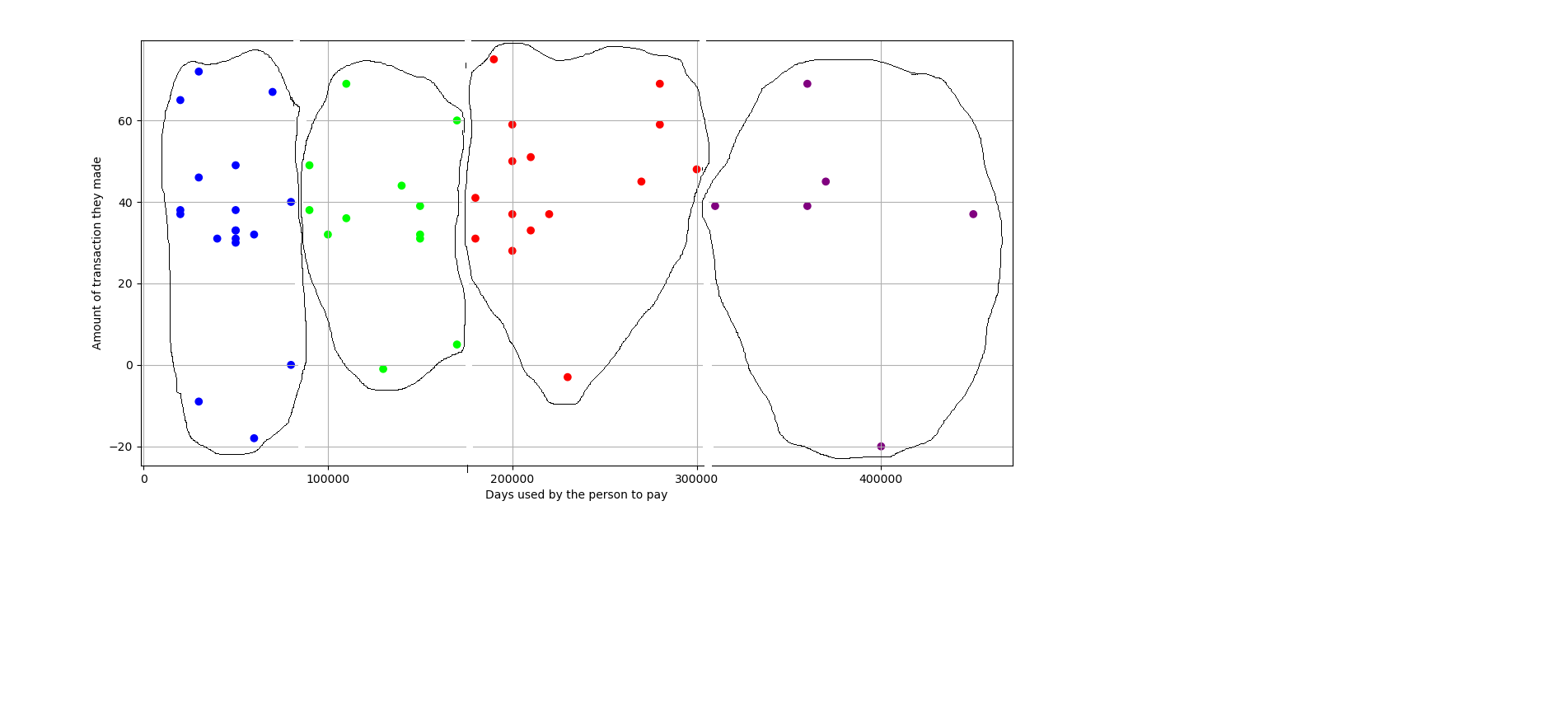

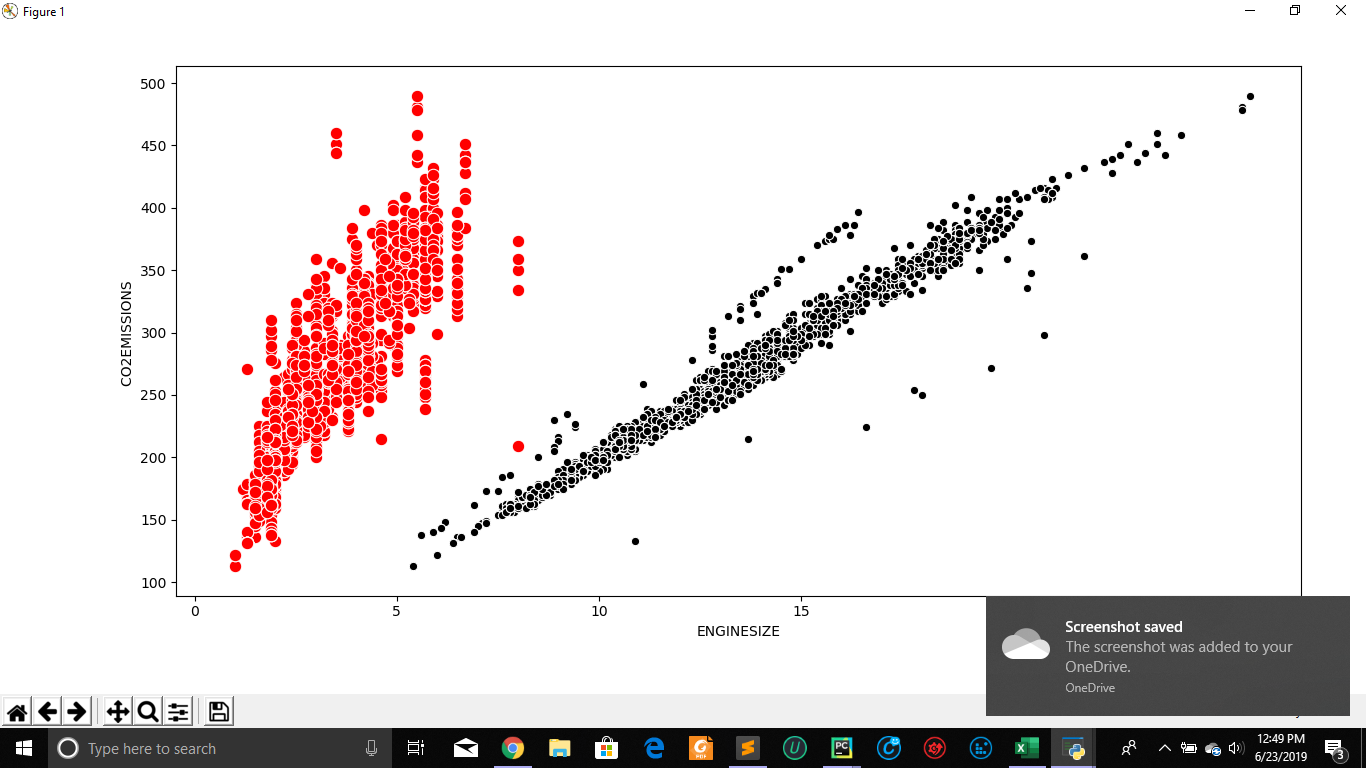

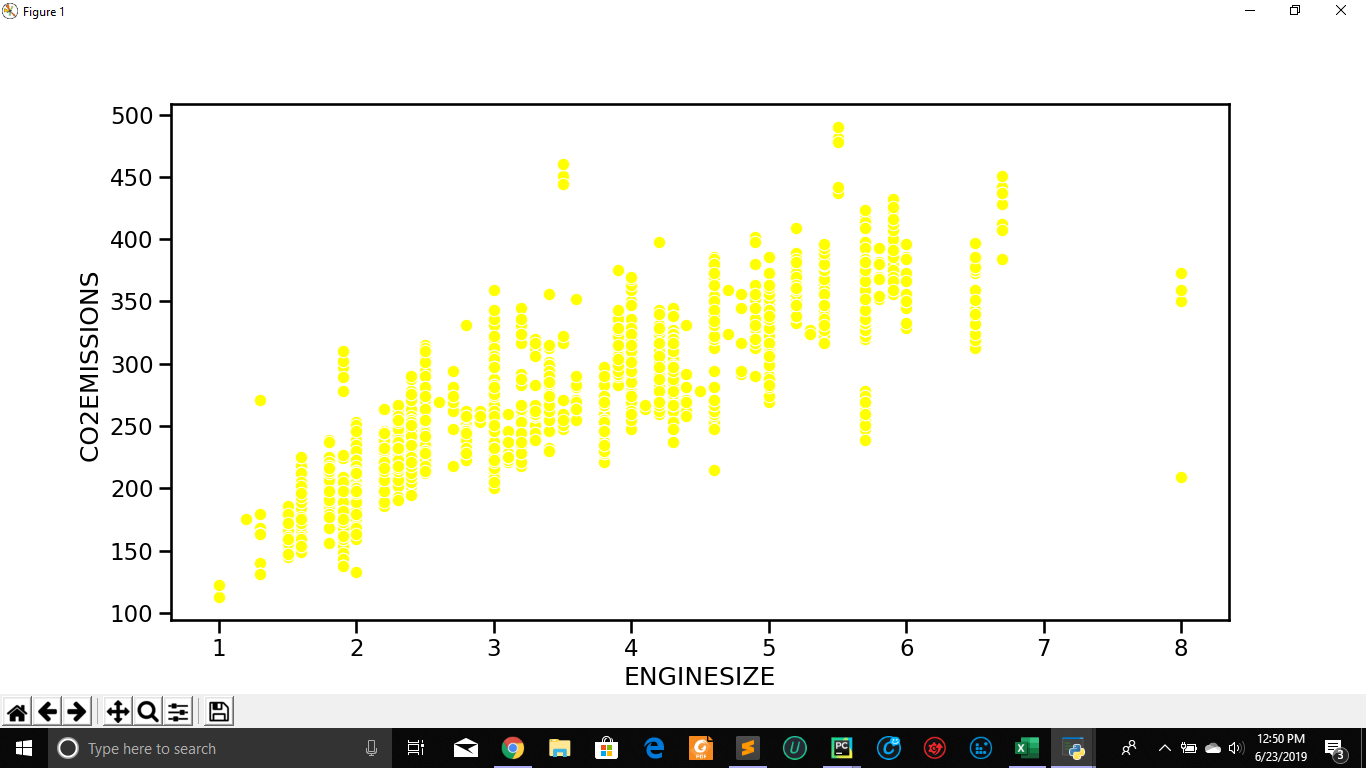

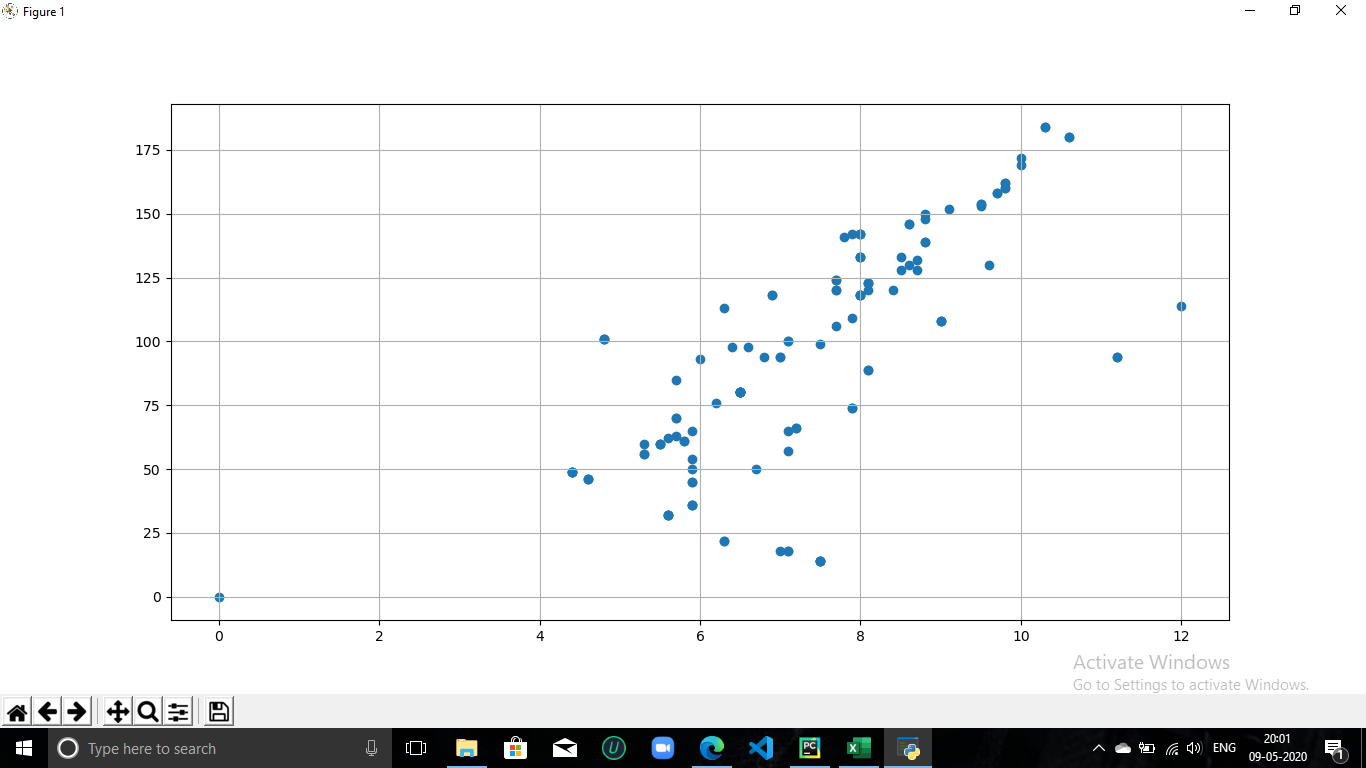

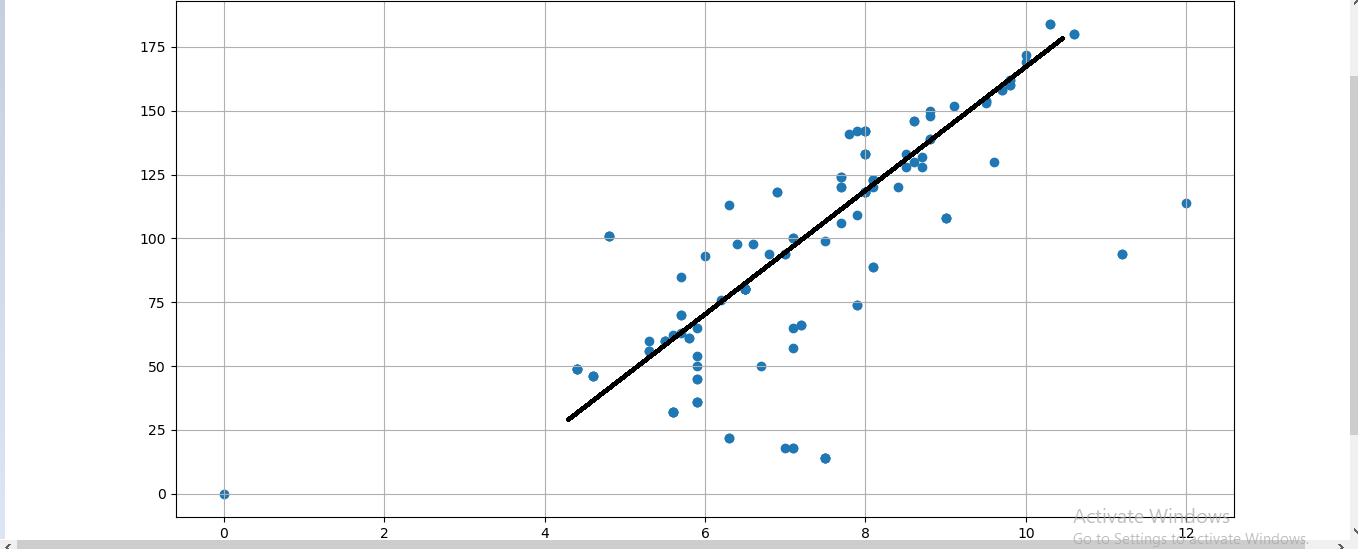

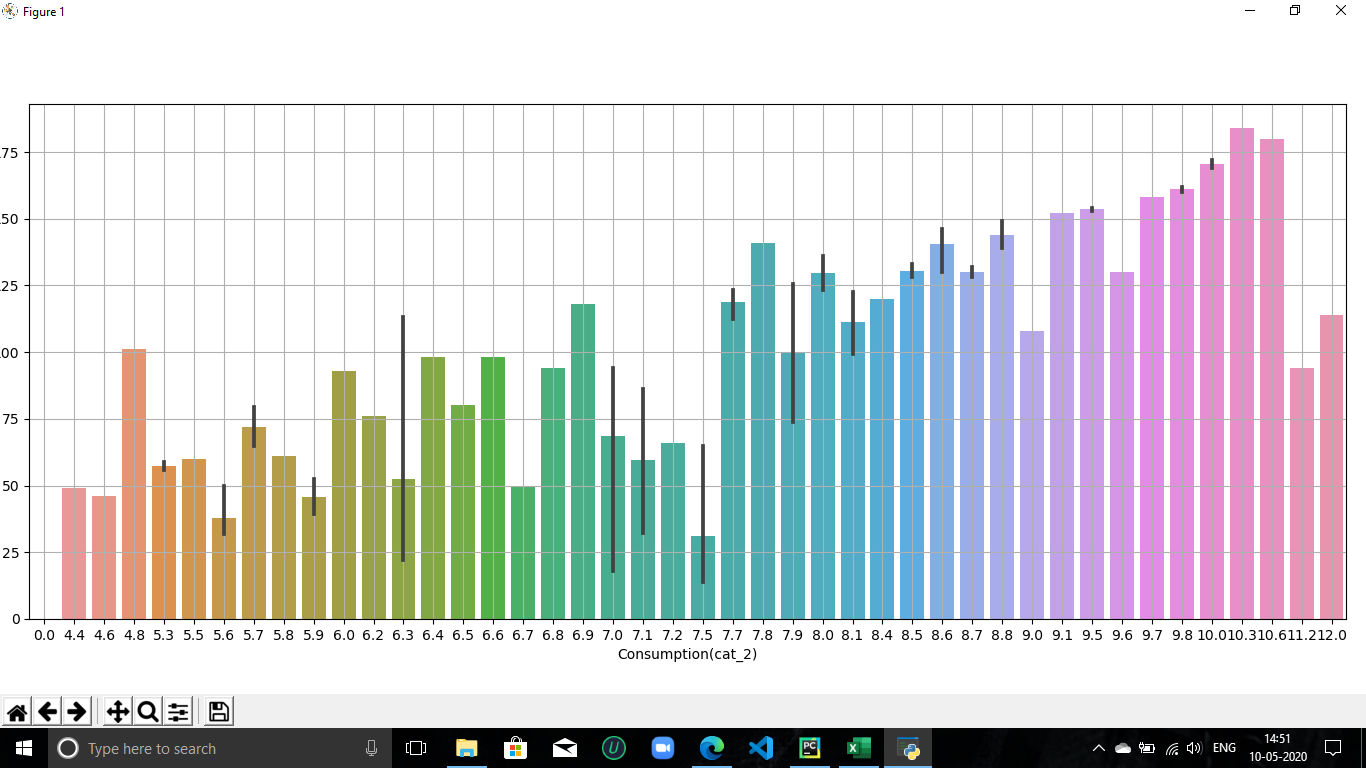

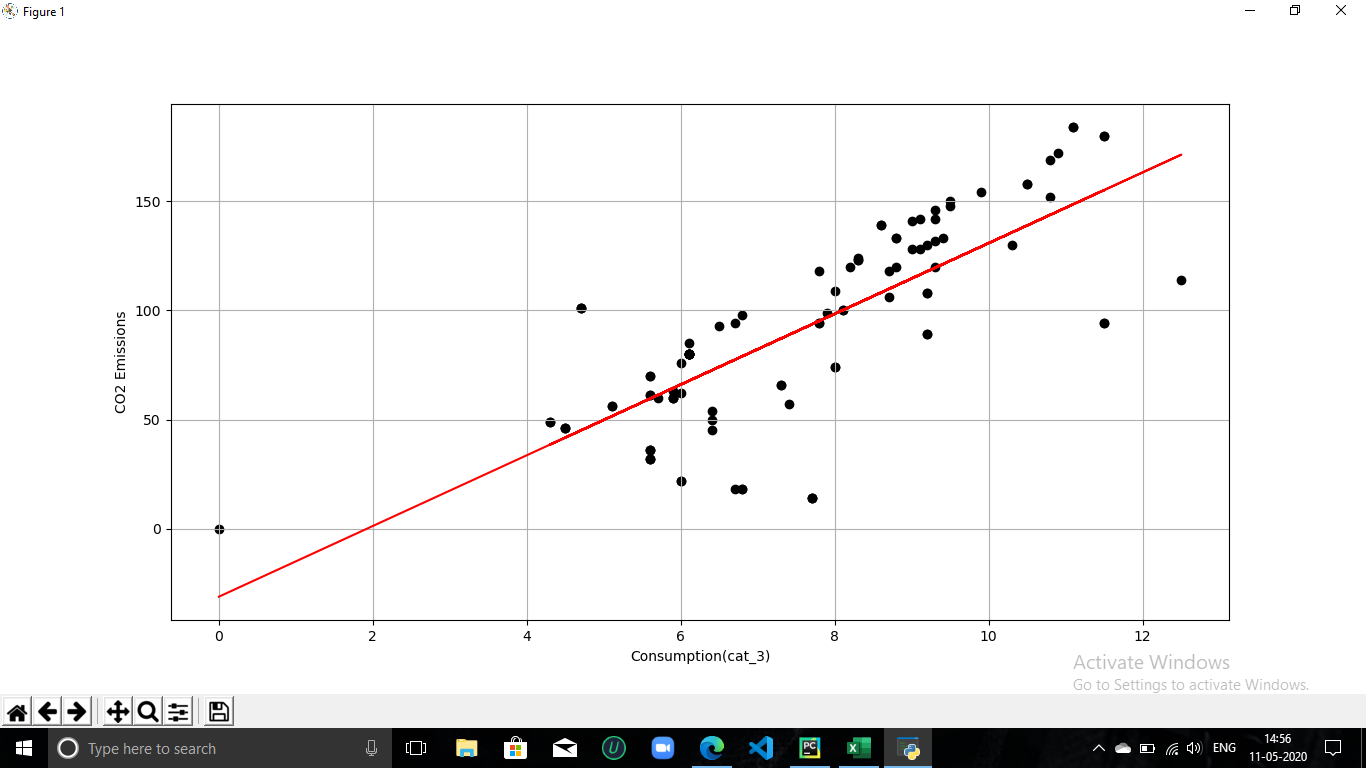

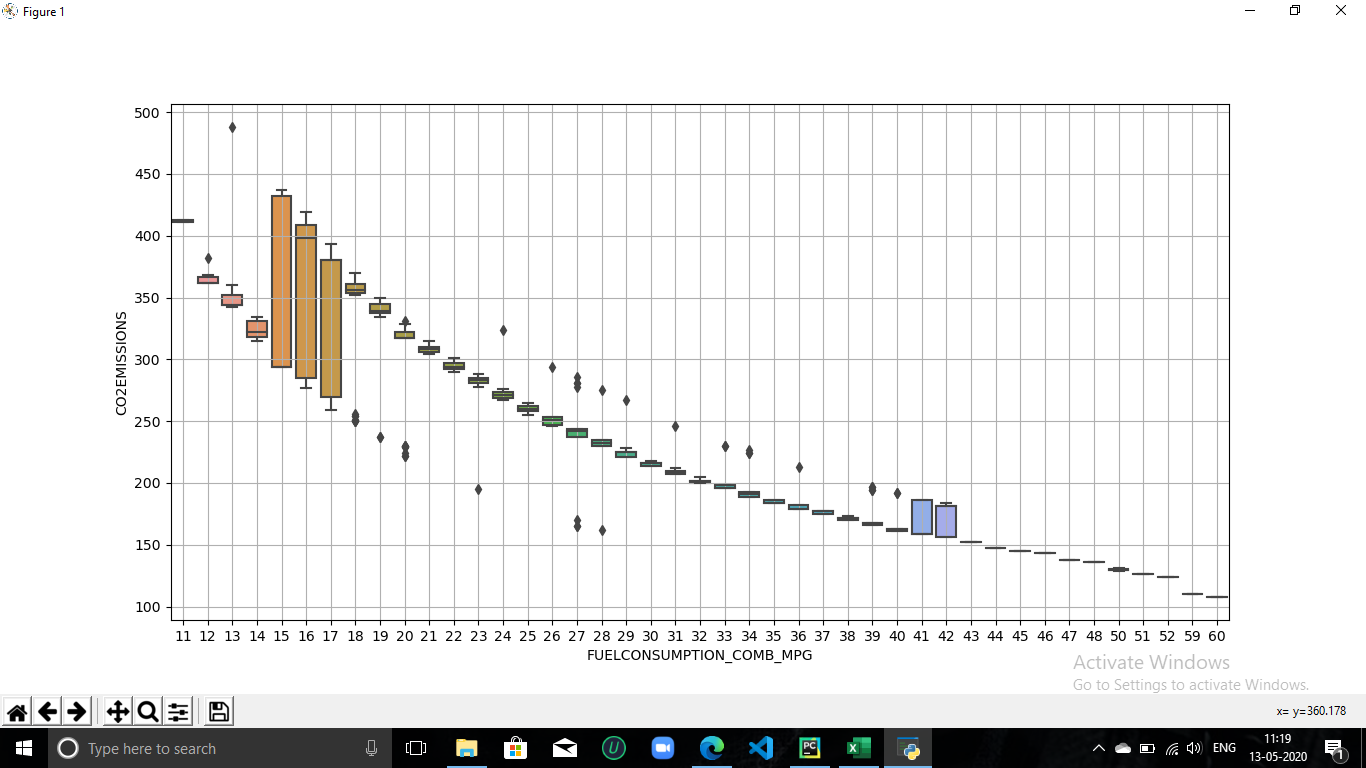

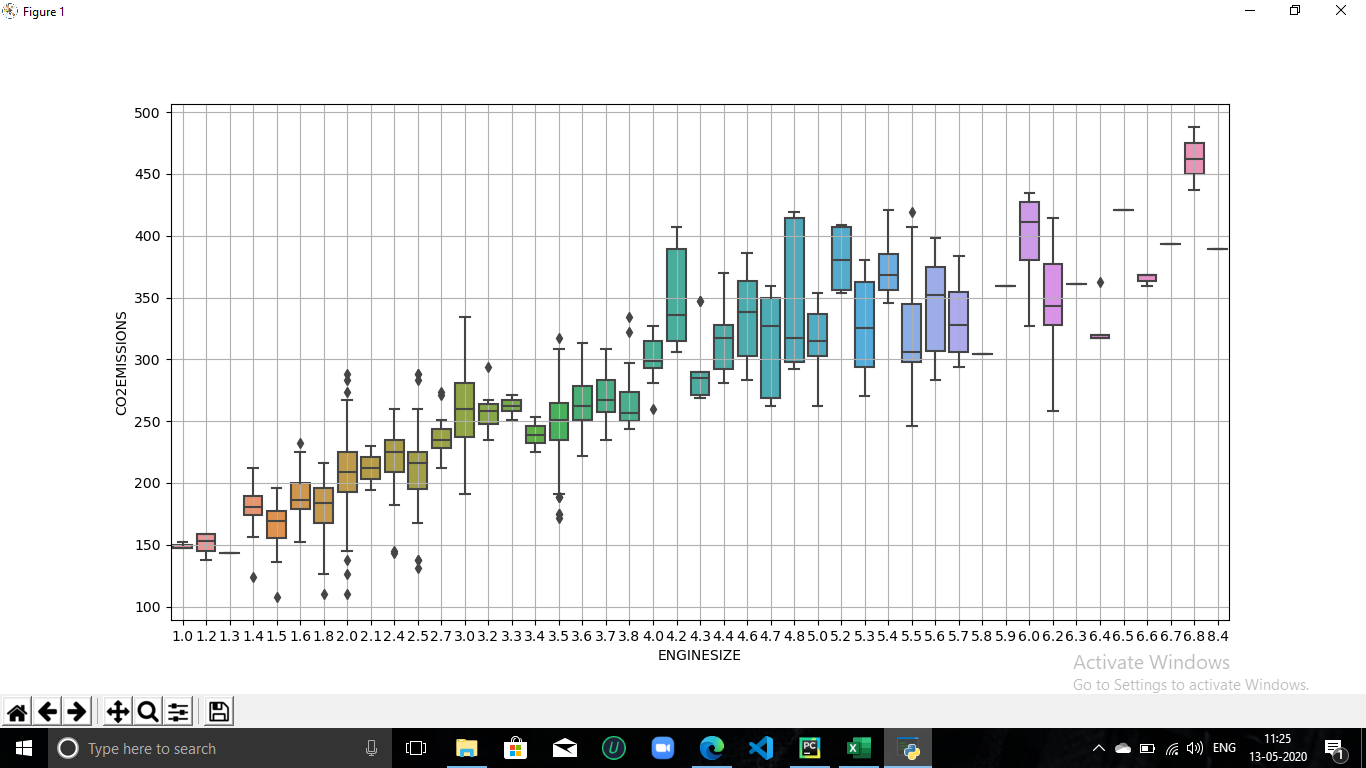

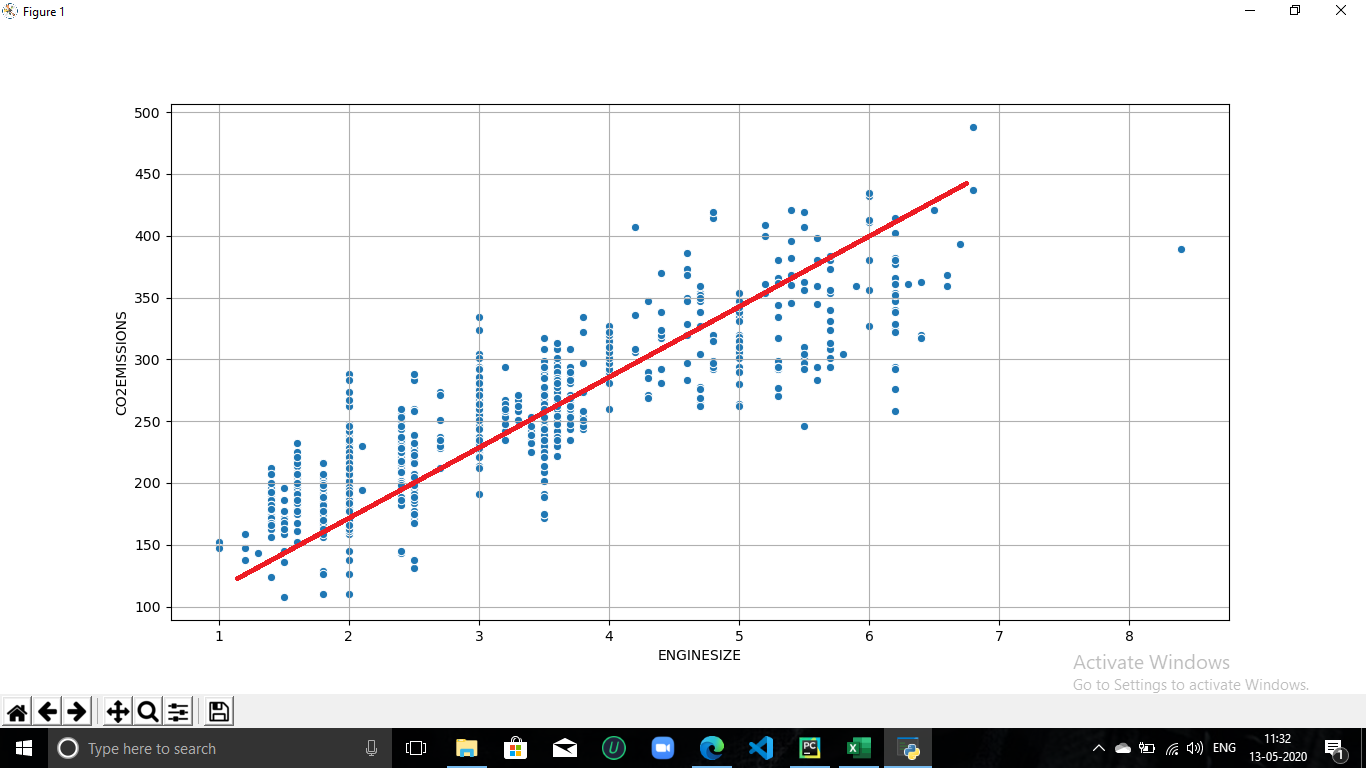

The data is getting captured in excel from the electronic device on which I prepared an algorithm in python using dash. Using this data I plot a scatter graph on which the x is (active power of transformer) and y is (reactive power of transformer). By plotting these two parameters we can calculate load from a scatter graph.

Now let's say I want to save the data points which are overload with the name of any label (for eg Label_1) so I can also save it and then visualize.

C) Future Scope

Let's say I am having a load monitoring center that is connected with all the electronic devices of a particular state. Now by using NILM I can control the load of all the devices which in turn helps the end-user in the consumption of electricity and money.